At Indyfluence, our programming is focused on helping our interns prepare for the future and start their careers off right. And one topic that’s especially important for young professionals is planning for your financial future. So, we decided to bring in an expert on the matter: Peter Dunn—or as he’s better known as, Pete the Planner!

Pete worked as a Financial Advisor for years, making him an expert in both the stock market and the economy (which he clarified the difference between). Now, as the author of several novels and host of his podcast, “The Pete the Planner Show,” he has a way of explaining numbers that’s informative, yet entertaining. He even started Wednesday’s workshop with a dancing cat on his screen!

Between the dancing cat and his pop music intro, Pete set a positive tone for the workshop right from the start. But before jumping into the numbers, Pete still chose to begin his “Starting Strong Financially” workshop with a Positive Focus Session.

After helping our interns focus their minds, Pete started the presentation with his “Emotional Rollercoaster” chart. This chart outlined the ebbs and flows of a person’s financial security—from the lows of depression to the highs of hope. But surprisingly, the words like depression and despondency were labelled as “maximum opportunity,” while hope and optimism fell under “maximum risk.” In a true “dad moment,” Pete met the interns’ eyes through the screen and said, “When things are the best, it’s generally the point of maximum risk, whereas when you’re at your lowest point, there is the greatest chance to rise above it.”

Then, he related this chart to the past financial year, revealing that the stock market fell by a whopping 34% in 2020! But despite that depressing statistic, Pete compared last year’s economic downfall to a video of his young son wiping out. His son might have fallen multiple times, but he was easily able to bounce back! Peter used this example to explain the difference between the stock market and economy, and that you can’t judge the economy by the stock market fluctuations. He warned the interns that it’s important to understand and remember the difference because it could greatly impact their financial security throughout their careers.

Next, Pete emphasized the importance of knowing the difference between being “comfortable” and having stability. In fact, those are two completely different things in terms of financial standings. Pete explained that this confusion is where most Americans go wrong, as the pandemic proved for many people. He said that being comfortable is based on your lifestyle, ignorance, and plain luck. After all, people think they’re stable “when they are able to go on vacation every once in a while.” But Pete said that’s more of a benchmark for being “comfortable” than being truly financially stable.

In terms of financial stability, Pete defined being stable as having enough money saved up for at least the next three months down the road. As Pete said, that stability is often very different from the “comfortable” savings many people have. He compared that comfortable mindset to someone who doesn’t wear a seatbelt, arrives safe one time, and then claims that: “Seatbelts are dumb. I don’t need to use them anymore!”

His point was that you can’t assume you’ll be safe in the future because you were safe in the past. You must be proactive and take precautions. Pete reminded the interns again and again that financial stability is “not a feeling, but a quantifiable destination.” And our interns will surely reflect on that advice as they embark on the next chapter of their careers!

To conclude this Workshop Wednesday, Pete had the interns participate in a financial stability test before allowing them to ask him any questions. He also said that no one should be embarrassed by their final scores, stating that in the financial world: “We don’t shame beginnings.”

And after a few questions, the “Starting Strong Financially” workshop came to an end. Between Pete’s jokes and the important information he shared, it was a very productive and comical afternoon for our Indyfluence interns!

You Might Like

New Developments Coming to Indianapolis

On June 28th, Eli Lilly and Company sponsored a collaborative event with Visit Indy called the Learn About Indy and Brand Yourself Workshop. During this event, we were able to learn about some incredible new developments and events coming to Indy. Many people in our...

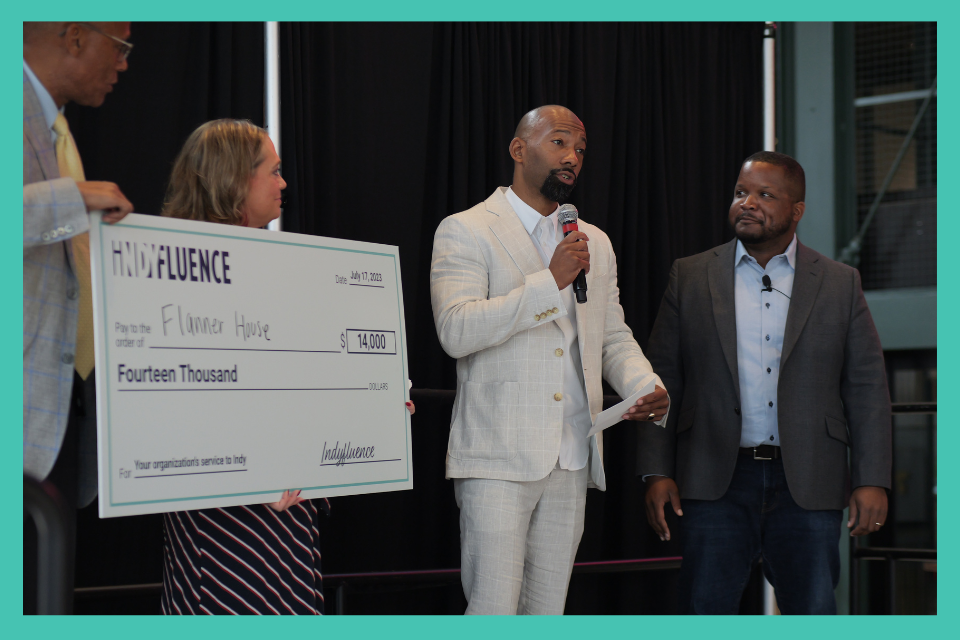

Indyfluence 2023 Full Program Recap

A LOOK BACK AT THE ENTIRE 2023 INDYFLUENCE PROGRAMIndyfluence is a four week internship program based on three pillars: MEET INDY, LEARN FROM INDY, and GIVE BACK TO INDY. The MEET INDY program pillar connected interns to important local events and organizations to...

RECAP: Indyfluence 2023 Closing Event

Congratulations to all of our interns on completing the 2023 Indyfluence program! The last four weeks have been jam packed with amazing events, activities, and content to help you MEET INDY, LEARN FROM INDY, and GIVE BACK to INDY! Time has really flown by, but we hope...

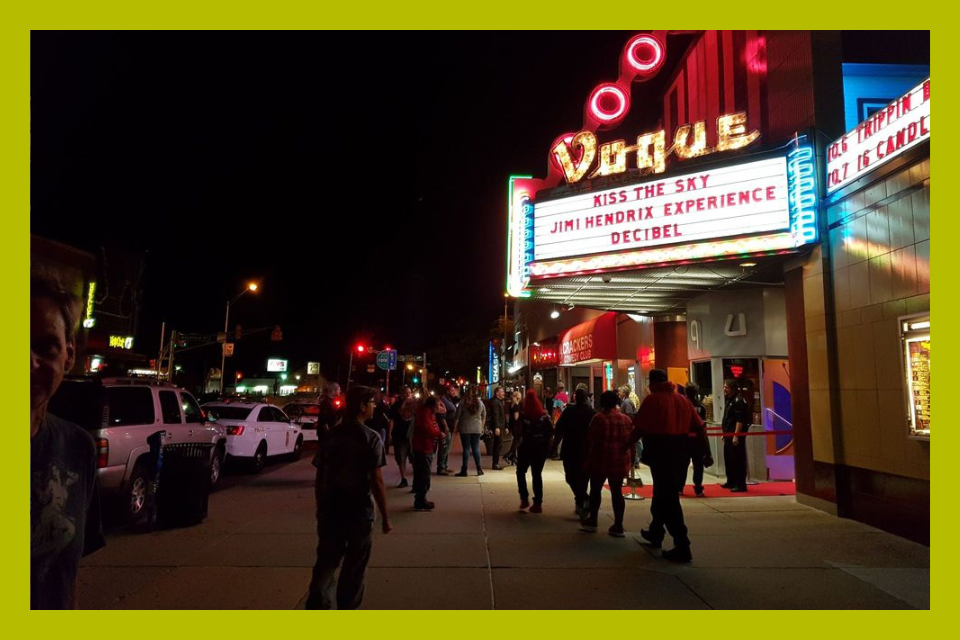

Top 10 Ways to Explore Nightlife in Indy

After a long day of work, you might want to get out and enjoy a night in the city with your friends. Whether you prefer a drink at a bar, some high-energy concert music, or even a magic show — Indianapolis has everything to offer. Here are a few of the best ways to...